ei Funding is an Orlando-based alternative finance company dedicated to providing small- to medium-sized B2B businesses the working capital needed to grow and ultimately become successful. I do this primarily through the funding methods of factoring and purchase order financing.

As a factoring company, the most frequently asked question I receive is: “How does invoice factoring work?” And the next most popular question, next to how to correctly pronounce my last name, is “How much does it cost?”.

This article is here to provide a detailed answer that addresses these two questions and if I do things right, it is my hope that by the end, you’ll come to understand both, as well as their potential benefits to your small- to medium-sized company. Let’s start first with: how does invoice factoring work?

What Is Invoice Factoring?

Simply put, invoice factoring is a cash advance against an invoice from the delivery of a product or service by a business.

A factor, like my company ei Funding, will advance a B2B business typically between 80% and 90% of the invoice’s face value, releasing the balance back to the Client in, say 30 days, once the invoice is paid, less a nominal factoring fee. Once a business sells its invoices to a factor, the collection of that invoice is handled by the factor. In this way, the small business client is free to use their cash advance from the invoice to focus on daily operations and growth, rather than chasing down Customers of aging invoices.

Factoring is an extremely versatile tool in that it can help businesses through beginning-of-the-year sales droughts, or alternatively, help growing companies make immediate changes to their product offering or project team so they can continue on their upward trajectory.

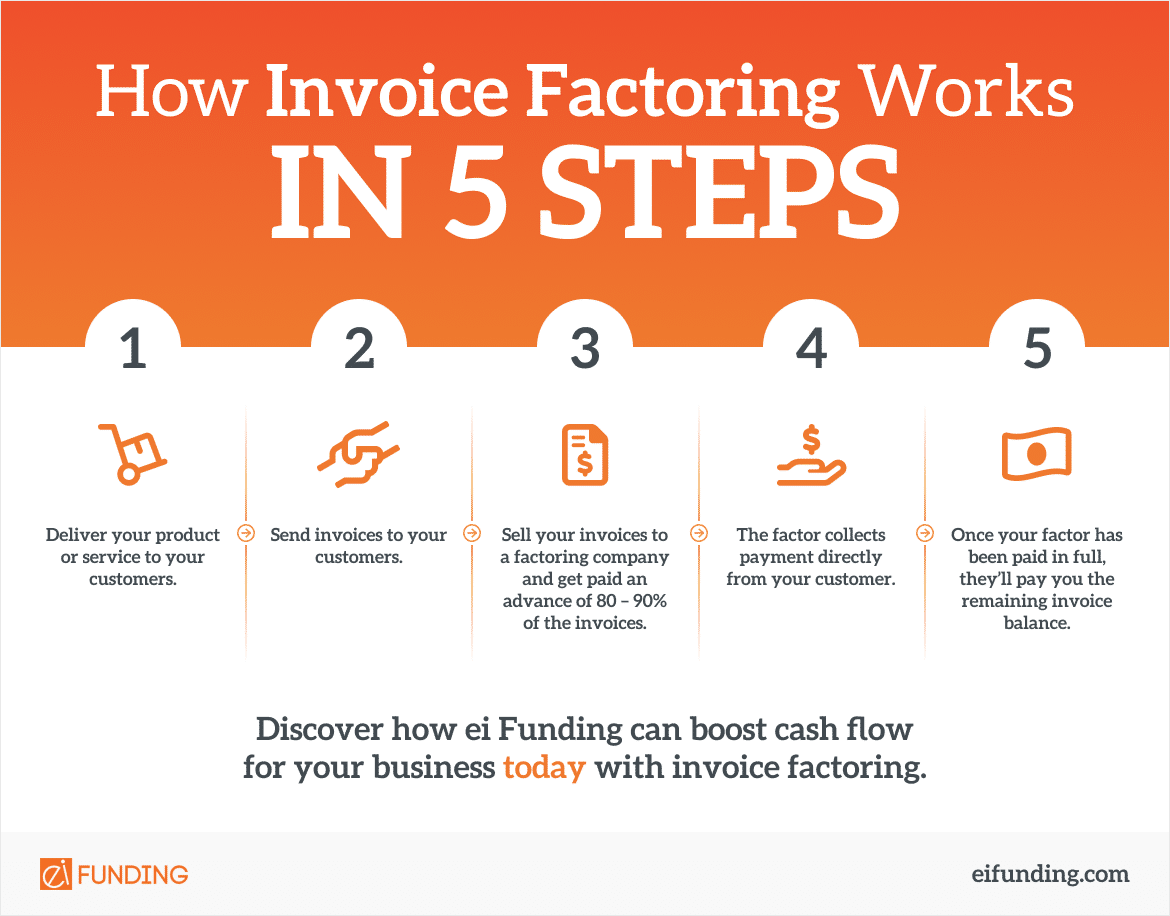

Invoice Factoring in 5 Steps

Now that you understand the basics of what invoice factoring is, you’re probably asking, “how does the process of factoring work?” Here it is broken down into five simple steps:

Step 1: You (the business) deliver your product or service to your Customers the way you normally do.

This part is easy because it doesn’t require you to change anything you’re currently doing within your organization’s processes.

Step 2: You send an invoice to your Customers for the product or service provided.

Once you’ve delivered your product or service, you send an invoice with the amount owed to your Customer.

Step 3: You sell the invoices to a factor, who will provide you an upfront, cash advance for most of the invoiced amount.

Once you’ve selected a trusted factoring company to work with, you will then sell them your delivered invoices. Once the invoices have been approved by your Customer, your factor will immediately pay you the majority of the amount being invoiced (usually between 80 and 90%). This is known as the factor’s “advance”.

The factoring fee for such an advance may vary between 2% and 3% for the first 30 days — this is known as the “discount rate”. The discount rate is the interest rate charged over the period the receivable is open or unpaid, typically expressed as a monthly interest rate. If the invoice is not paid within the first 30 days, a daily rate is usually charged, which is simply the monthly discount rate divided by 30 days and expressed as a per-day percentage.

Step 4: The factor collects payment from your Customers directly.

Because you’ve sold your invoices to your factor, you have the peace of mind knowing that the factoring company is responsible for collecting on payments from Customers directly — not you.

Step 5: Once the factor has been paid in full, they will pay you the remaining balance on the invoice.

Your factor will secure payments from your Customers and provide you with the remaining invoice amount owed.

How Much Does It Cost?

To turn our attention from “how does factoring work” to the second question on factoring related to “how much does it cost”, here is a simple example using a $10,000 invoice, an 80% advance rate, a 2.5% discount rate, on an invoice which is due and payable in 30 days.

- ABC Widgets sells its products to XYZ Nuts & Bolts and submits an invoice to them for $10,000.

- ei Funding (the factor) advances ABC Widgets $8,000 (which is 80% of $10,000) less the 2.5% factoring fee or $250 (0.025 x $10,000). The total advance amount ABC Widgets receives is $7,750 ($8,000 – $250 = $7,750).

- In 30 days, when the invoice is paid by XYZ Nuts & Bolts, ei Funding releases the 20% balance amount owed to ABC Widgets (called the “reserve”), which in our example, is $2,000.

In summary, the net receipts to ABC Widgets from factoring are $7,750 + $2,000 = $9,750, and the net costs are $250 (or 2.5% of $10,000).

Benefits of Invoice Factoring

The benefits to a company for using Factoring to meet its cash needs are many — some of which include receiving rapid funding (very often the same day) on their sales, flexibility of using it only with the Customers you choose, as well as the benefit of a funding tool which can grow along with your company’s growth.

Because invoice factoring is not a bank loan, a credit card, a merchant cash advance or invoice financing, the application process is relatively straightforward and fast. Saving you time and money, as well as avoiding the headaches typically associated with having to jump through hoops as part of a long and complicated application process.

For more information, see how invoice factoring compares to other financial alternatives now.

Getting Started with Invoice Factoring

Now that you know how factoring works, take our factoring quiz or visit the link below to find out how ei Funding can boost cash flow for your B2B business today using invoice factoring.