An Intro to the Telecom Industry

If you’re in the telecom business, you know how competitive and ever-changing the industry has become over the years, especially within the U.S. With telecommunications being an integral part of nearly every industry, serving as the hub for technologies, equipment, networks and applications and even our homes, its reach has expanded to telephone companies, internet service providers, cable system operators and more.

Whether it’s building out new towers, purchasing bucket trucks, providing the upgrades to receive 5G or laying fiber, telecom has grown into a necessary industry and service to support growing businesses now and well into the foreseeable future.

Because of this demand in services, telecom companies like yours are faced with both new challenges and tremendous opportunities. With the industry’s rapid growth, the need for effective telecom financing becomes essential, providing a strategic solution to confidently make investments and manage the stress of funding immediate expenses and collecting on outstanding invoices.

Financial Challenges Many Telecom Companies Face

- Growth and Correlating Expenses, Like New Equipment, Materials and Staffing: Is your business growing? Fantastic! However, with growth comes the need for additional resources to get the job done right. Whether it’s new equipment, new team members or just materials, these resources come at a cost, which means you need the cash today to finance them.

- Finding the Best Option to Finance Your Growth: With the expenses that come with sudden growth, it can be tempting to find the fastest, easiest option that yields the highest cash flow right now. However, smart telecom companies are mindful of what their businesses’ financial health will look like long-term. That means finding a financing solution that fits your business — in the right amount and at the right cost that will allow your business to continue to grow.

- New, Bigger Customers and Slower Payments: Like many businesses, collecting on unpaid invoices can be challenging for telecom companies, especially when you’re trying to focus on daily operations and growth. In telecom, payment terms of up to 90 days is not uncommon. Managing cash flow over longer payment terms and having to chase them down can be challenging to your small business, consuming precious time and money.

- Fewer Opportunities to Get a Bank Loan: With the unpredictable and negative effects brought on by the COVID pandemic, bank lending has become more restrictive — even to growing telecom companies like yours. To avoid the frustration of being turned down by a traditional lender, you need another option to fuel your telecom company’s growth.

Telecom Financing Options

When you’re looking into telecom financing, it’s important to know what cash advance options you have to help you get cash on hand as soon as possible to fund your growing business. While there are several options out there, not all are going to yield the best results. Many of them can actually cost your business a great deal more than others long-term.

Bank Loans

Pros:

- Average loan amount is around $350,000 (other loans range from $5,000 to $500,000, depending on your circumstances)

Cons:

- Tons of fees to deal with (application fee, origination fee, guaranty fee, annual fee, late-payment fee, etc.)

- Lengthy approval process (can take up to 2 – 3 months to get approved)

- Turnaround time can take between 14 – 90 days to see any funding

- A higher credit score is usually required (typically a 730 or higher)

- Payback period can last up to 25 years, depending on the loan type

Credit Cards

Pros:

- Turnaround time can be very quick (ASAP via ATM withdrawal, in-person withdrawal from bank or a cash advance convenience check)

- Quick and easy online application + quick approval process (often within seconds of submitting)

- Payback period can be anytime (*however, the longer you have an outstanding balance, the more you will owe in interest)

Cons:

- Average credit limit is around ~$6,000 (+ interest, if not paid within the designated pay cycle) — so, clearly, it’s not a long-term solution to finance your business’s growth

- Average cash advance is only 30 – 50% of overall credit limit, which makes situations where you need cash on hand very difficult

- All your working capital needs will never be furnished with credit cards (limits are based on your credit worthiness, and once reached, are difficult to surpass until paid down)

- Tons of fees to deal with (application fee, interest charges, cash advance fee, annual fee, late-payment fee, etc.), making them a very, very expensive option

- A higher credit score is usually required (typically a 670 or higher)

- Payback period is long and can be very costly in the long run with accrued interest

Merchant Cash Advances

Pros:

- Average MCA amount is between $5,000 – $500,000

- Relatively quick and easy online application and approval process (typically, a response is provided in one or two business days)

- Turnaround time for funding can be as soon as 48 hours

- Good credit score isn’t required — approval is based on your business’s ability to pay back the loan from future revenue

Cons

- Costs and fees: 30 – 50% more than the principal amount and daily payments drafted from your business account based on a predetermined amount by the MCA company

- Repayment terms are typically between 3 – 10 months, with daily drafts from your business checking account draining your cash on hand

- MCA companies employ a “Consent of Judgement” clause, which means if payments are not made, a default judgement is automatically entered against your small business

Invoice Factoring (*The Best Choice for Your Money)

Pros:

- Quick and easy application and approval process (applicants are contacted within 1 business day)

- Transparent and simple pricing with no “gotcha” or hidden fees

- Rapid funding (can typically be the same day as approval)

- Credit evaluation not on the individual, but on the business — as a result, not dependent on the quality of your credit score

Cons:

- Like everything in life, you will have to fill out an application. Don’t worry though — it’s straightforward and easy to do!

Funding Your Telecom Equipment Purchases

To stay competitive in the telecom industry, it’s important to ensure you have the right tools and equipment to get the job done efficiently and effectively. But when you’re looking to upgrade or expand your current equipment, the high costs of these tools, when purchased new, can be prohibitive.

However, telecom equipment financing allows you to acquire the essential equipment your telecom business needs to grow and thrive in a highly competitive market without paying the full amount upfront.

How Does Equipment Financing Work?

Equipment financing is a type of loan used to purchase a piece of business equipment. Depending on your lender and the terms of your agreement, your loan may provide 100% of the funds needed to cover the equipment cost or only a portion of the total cost. Once you buy the equipment, you repay the money loaned in regular installments with interest over a fixed term. The equipment itself acts as collateral for the loan.

It’s important not to confuse equipment financing with equipment leasing. When you lease your telecom equipment, you never actually own the asset. At the end of your agreement, you must either renew the lease, return the equipment or purchase it from the leasing company. On the other hand, with equipment financing, once you pay off the loan and fulfill the terms of your loan agreement, your company will own the equipment, allowing you to build equity.

Telecom equipment financing is simply the application of equipment financing in the telecom industry. It allows you to upgrade your equipment so your business can generate more income and, in turn, give you the cash flow boost you need to pay off the initial investment.

Here are two common use cases for telecom equipment financing:

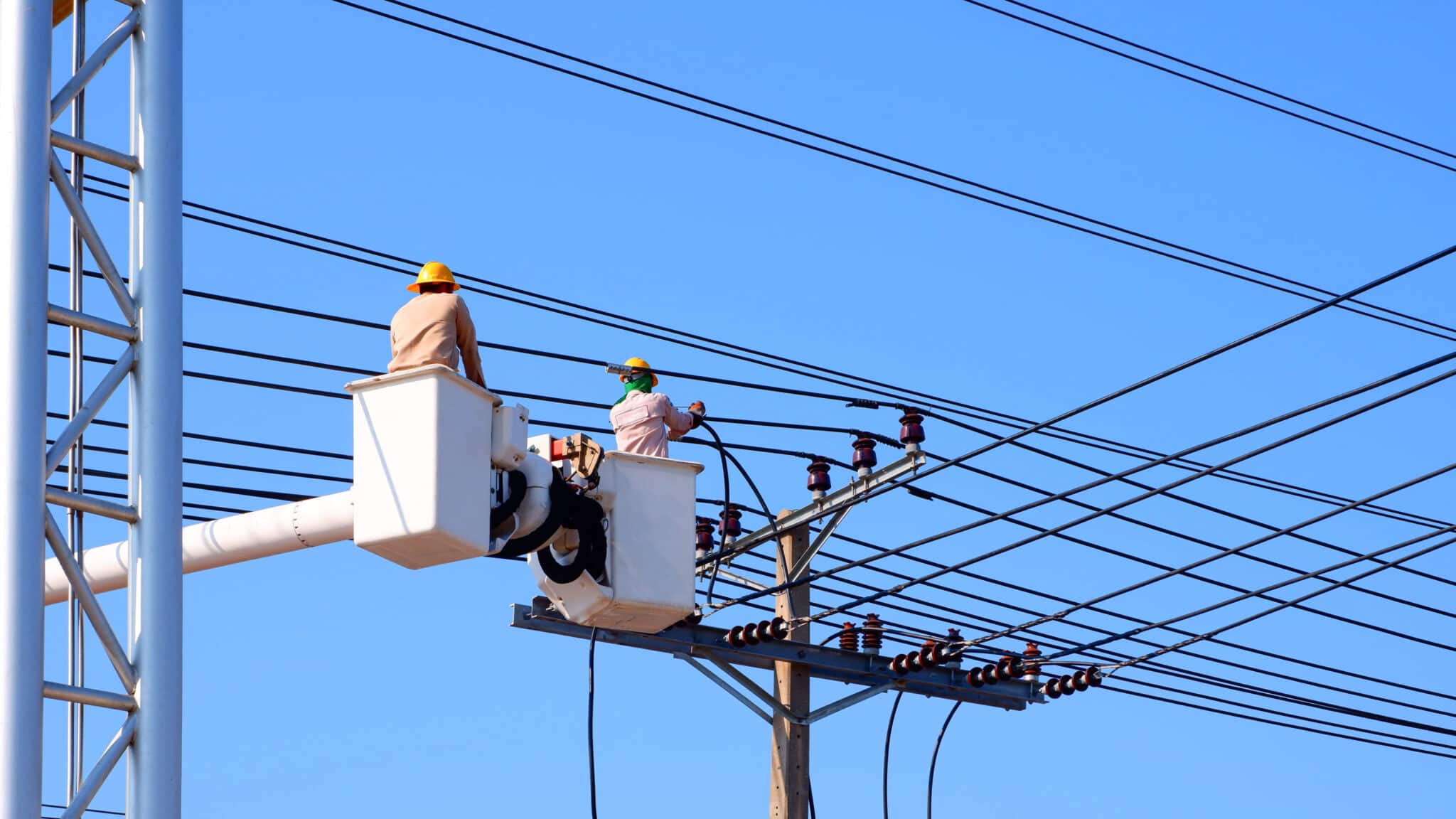

Buying a Bucket Truck

Bucket trucks are a type of vehicle featuring an aerial lift used to elevate workers up to 50 feet in the air. They are used by telecommunications companies for the installation and repair of above-ground cables and cost several thousands of dollars.

To buy a bucket truck with telecom equipment financing, there are three basic steps:

- Identify the make and model of the bucket truck you want to purchase. As with most vehicles and machinery, buying new will be more expensive than buying used. However, newer equipment may last longer and require fewer repairs than older models.

- Identify a lender who offers financing that meets your funding needs. Ideally, work with a lender who has experience with telecom companies and is willing to work with you to negotiate terms that meet the lender’s and your business’s needs.

- Complete the application process. Reputable lenders will request documentation of your company’s financial and credit history. Many lenders require your business to have a certain credit score, but the specific number varies between providers. The time between application and approval can range from a few days to several weeks, depending on the lending institution.

Once approved, you will receive the funds needed to purchase under the terms you agreed to with your lender.

Buying a Horizontal Directional Drill

Horizontal directional drills are used to drill underground tunnels for cables, typically under waterways or other areas where digging an open trench would be impractical or impossible. They are essential for installing and maintaining underground cables but cost hundreds of thousands of dollars when purchased new.

Similar to the bucket truck example above, there are three basic steps to buying horizontal directional drills with telecom equipment financing:

- Identify the make and model of the horizontal directional drill you want to purchase. Ditch Witch and Vermeer are both brands used by ei Funding clients who have found them reliable equipment manufacturers.

- Identify a lender who offers financing that meets your funding needs. Once you’ve decided on your model, find a lender who offers financing to cover most or all of the purchase price.

- Complete the application process. If you meet the lender’s credit and financial history qualifications, you can move forward with financing the drill. From there, purchasing the equipment and repaying the loan will be dictated by the terms of your agreement with your provider.

Frequently Asked Questions About Telecom Financing

1. What is telecommunication financing and how can it benefit my company?

Telecommunication financing refers to a range of funding options tailored to meet the unique needs of companies in the telecommunications industry. It can benefit your company by providing the capital needed for expansion, upgrading technology or managing cash flow more effectively.

2. How does telecom finance differ from regular business financing?

Telecom finance is specifically designed to address the high costs and rapid technological changes associated with the telecom industry. It often involves understanding the nuances of the industry, including the need for specialized equipment, long project cycles and regulatory considerations.

3. What should I consider when looking for business telecom services for finance?

When seeking finance for business telecom services, consider lenders’ familiarity with the telecom industry, the flexibility of the financing options offered, how quickly you can access funds and the overall cost of financing.

4. What are the typical requirements for telecom company financing?

Typical requirements might include a detailed business plan, financial statements, proof of revenue or contracts, credit history and sometimes collateral. Lenders will also look at your company’s track record in the industry and the viability of your plans for the use of the funds.

5. What do lenders look for when providing telecom finance?

Lenders look for a solid business plan, a history of profitability or a clear path to profit, stability in the industry, the creditworthiness of the business and realistic revenue projections. They also consider the overall health of the telecom industry and any collateral offered.

6. How can I effectively manage telecom financing to grow my business?

To manage financing effectively, regularly review your finances, understand the terms and conditions of your financing agreement, use funds for intended purposes and always consider the long-term implications of any financing decision on your business’s health and growth.

Why Factoring Is the Best Financing Option for your Business

With factoring, you aren’t tying yourself down to long payback periods with monthly or daily installments like with bank loans or merchant cash advances. The money your factor advances you is your money in the first place. It’s collected from your service or product invoices and provided to you from your factor, minus a small fee.

Factoring ensures you won’t need to spend time or money dealing with interest rates, daily withdrawals, or paying off money borrowed plus interest at the end of a term loan.

This leaves you with time and money to focus on what you do best: run and grow your business. Download our free guide to invoice factoring today to learn more about how factoring can help your telecom business.

Hear It From Happy Telecom Businesses Like Yours

“If it wasn’t for Ernane, I’m not sure where I’d be right now with my business. He’s on top of everything. I can hire more technicians now and I’ve grown the business by about 20 percent. I have no words to describe how much he’s helped me and how he’s helping my business grow. I definitely recommend working with him to anybody. Once they see how on-point he is, they’ll love him.” — James Quiles, Owner, A&J Telecommunications, LLC

The Telecom Financing You Need Starts With ei Funding

Ready for a safe, easy and inexpensive way to get the cash you need today to grow your telecom business? Let ei Funding be your trusted solution.

Not only do we provide up to 90% of the funds on your unpaid invoices for only a nominal fee, we also provide financial advisory services, which include debt consolidation and even equipment financing secured by your factored receivables to help ensure your business keeps on growing steadily and profitably.

At ei Funding, our success is your success. Apply today to get started!